Advanzia Bank is a European online bank that offers various financial products and services. Among these is the popular Gebührenfrei Mastercard Gold credit card, which comes with a host of benefits, such as no foreign transaction fees, travel insurance, and cashback rewards.

Additionally, Advanzia Bank offers online banking services to help customers manage their accounts from anywhere in the world.

In this blog post, we will explore Advanzia Bank’s online banking services, including the My Gebuhrenfrei portal, and how to access and use them.

Advanzia Bank Online Banking: Accessing and Using My Gebuhrenfrei Portal

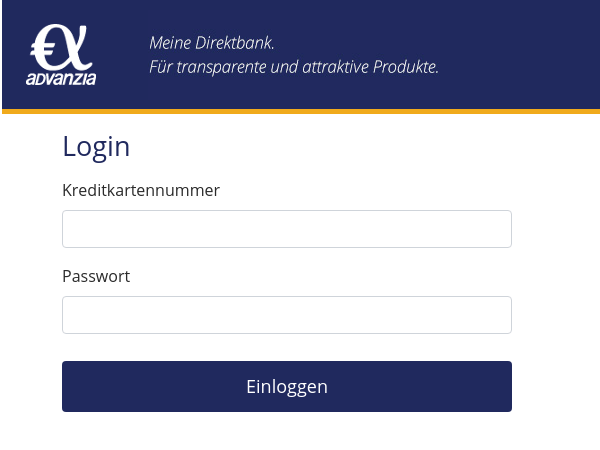

To access Advanzia Bank’s online banking portal, customers need to first register for My Gebuhrenfrei.

This can be done easily by visiting the Advanzia Bank website and clicking on the “My Gebuhrenfrei” tab.

From there, customers will need to provide their credit card number, date of birth, and email address to register.

Once registered, customers can log in to the My Gebuhrenfrei portal using their email address and a password.

Main Features of My Gebuhrenfrei Portal

The My Gebuhrenfrei portal offers a range of features that enable customers to manage their credit card accounts easily.

Here are some of the main features of the portal:

- View Account Information: Once logged in to the My Gebuhrenfrei portal, customers can view their account balance, credit limit, available credit, and transaction history.

- Set up Direct Debits: Customers can set up direct debits to automatically pay their credit card bills. This can be done by providing the necessary information and choosing the amount and frequency of the payments.

- Make Payments: Customers can make payments to their credit card accounts using the My Gebuhrenfrei portal. Payments can be made using a bank transfer or by setting up a standing order.

- Manage Alerts: Customers can set up alerts to receive notifications when their credit card statement is available, when a payment is due, or when a transaction is made.

- Change Personal Information: Customers can update their personal information, such as their address and contact details, using the My Gebuhrenfrei portal.

Advanzia Bank Online Banking: Using the Mobile App

In addition to the My Gebuhrenfrei portal, Advanzia Bank also offers a mobile app for iOS and Android devices. The app provides customers with convenient access to their credit card accounts, allowing them to manage their finances on the go.

Some of the features of the Advanzia Bank mobile app include:

- View Account Information: Customers can view their account balance, credit limit, available credit, and transaction history.

- Set up Direct Debits: Customers can set up direct debits to automatically pay their credit card bills using the mobile app.

- Make Payments: Customers can make payments to their credit card accounts using the mobile app. Payments can be made using a bank transfer or by setting up a standing order.

- Manage Alerts: Customers can set up alerts to receive notifications when their credit card statement is available, when a payment is due, or when a transaction is made.

- Block and Unblock Card: Customers can block their credit card if it is lost or stolen using the mobile app. They can also unblock their card if it is found.

Advanzia Bank Online Banking: Security and Privacy

Advanzia Bank takes the security and privacy of its customers seriously. The My Gebuhrenfrei portal and mobile app are secured using industry-standard encryption and authentication technologies to ensure that customer data is protected. Additionally, Advanzia Bank does not share customer information with third parties without their consent.

Conclusion

In conclusion, Advanzia Bank’s online banking service provides customers with an efficient, secure, and user-friendly platform to manage their finances.

With its numerous features, including bill payments, transfer options, and account monitoring tools, it offers customers a seamless banking experience.

Whether you are accessing your account through a computer or mobile device, Advanzia Bank’s online banking service is easily accessible and available 24/7.

So, if you’re looking for a reliable and convenient way to manage your finances, consider signing up for Advanzia Bank’s online banking service today.

Frequently Asked Questions

Here are some common questions that people ask about Advanzia Bank online banking.

What is Advanzia Bank online banking?

Advanzia Bank online banking is a web-based banking system that allows customers to manage their accounts and perform various financial transactions through the internet.

How can I access Advanzia Bank online banking?

To access Advanzia Bank online banking, you need to log in to the online banking portal using your username and password. If you are a new customer, you can register for online banking on the Advanzia Bank website.

How do I open an Advanzia Bank online account?

To open an Advanzia Bank online account, you can visit their website and follow the instructions to apply for an account. You will need to provide personal information such as your name, address, and identification documents.

Is Advanzia Bank online banking safe?

Yes, Advanzia Bank online banking is secure. The bank uses various security measures to protect its customers’ personal and financial information, such as encryption, firewalls, and two-factor authentication.

What services can I perform with Advanzia Bank online banking?

With Advanzia Bank online banking, you can perform a variety of financial transactions, including checking your account balance, transferring money, paying bills, and managing your credit card account.

What do I do if I forget my Advanzia Bank online banking password?

If you forget your Advanzia Bank online banking password, you can reset it by clicking on the “Forgot your password?” link on the login page. You will be prompted to enter your username and follow the instructions to reset your password.