Advanzia Bank’s credit card is a popular choice for German consumers looking for a reliable and cost-effective way to make purchases both domestically and internationally. The Advanzia credit card offers a range of benefits, including a low annual fee, no foreign transaction fees, and cashback rewards.

In this article, we will explore everything you need to know about the Advanzia Mastercard Gold, from its features and benefits to how to apply for one.

Advanzia Credit Card Features and Benefits

Advanzia’s credit card is a Mastercard Gold that comes with a number of features and benefits, including:

- No annual fee: Unlike many other credit cards, the Advanzia credit card does not charge an annual fee, making it an affordable option for consumers.

- No foreign transaction fees: The Advanzia credit card does not charge any fees for transactions made in foreign currencies, making it an excellent choice for international travel.

- Cashback rewards: The Advanzia credit card offers cashback rewards on all purchases, with higher cashback rates for purchases made at certain retailers.

- Credit limit: The Advanzia credit card has a credit limit that is determined based on the applicant’s creditworthiness.

Applying for an Advanzia Credit Card

To apply for the gold credit card from Advanzia Bank, you will need to meet certain eligibility requirements, including being a permanent resident of Germany and at least 18 years old. You will also need to provide documentation such as proof of income and identification.

Once you have met the eligibility requirements, you can apply for an Advanzia gold card online. The application process is straightforward and can be completed in just a few minutes. You will need to provide personal information such as your name, address, and contact information. You will also need to provide information about your employment and income.

Advanzia Credit Card Interest Rates and Limits

The credit limit for the Advanzia credit card is determined based on the applicant’s creditworthiness. The credit limit can range from a few hundred euros to several thousand euros. Advanzia Bank offers customers the option to increase their credit limit after a certain period of time and with a positive credit history.

The interest rate for the Advanzia credit card is determined based on the applicant’s creditworthiness and can vary from person to person. It is important to note that if you carry a balance on your Advanzia credit card, you will be charged interest on the outstanding balance.

Advanzia Customer Service

Advanzia Bank offers customers a range of customer service options, including phone support and email support. If you have any questions or concerns about your Advanzia card, you can contact Advanzia customer service for assistance.

Advanzia Credit Card Security

Advanzia Bank takes the security of its credit card customers seriously and has implemented a number of measures to protect against fraud and unauthorized transactions. The Advanzia credit card comes with 3D Secure authentication, which adds an extra layer of security to online purchases. The card also includes chip-and-PIN technology, which makes it more difficult for fraudsters to replicate the card.

Conclusion

The Advanzia credit card is a popular choice for German consumers looking for a cost-effective and reliable way to make purchases both domestically and internationally. With no annual fee, no foreign transaction fees, and cashback rewards, it offers a range of benefits that make it an excellent choice for everyday use. If you are interested in applying for an Advanzia credit card, be sure to review the eligibility requirements and the card’s features and benefits before applying.

FAQs about Advanzia Master Card Gold

Here are some common questions about Advanzia Credit Card and their answers to help you understand better.

What is Advanzia Credit Card, and how does it work?

Advanzia Credit Card is a Mastercard Gold credit card that offers various benefits like free cash withdrawals, no foreign transaction fees, and no annual fees. You can use it to make payments and withdraw cash worldwide, both online and offline.

How can I apply for an Advanzia Card?

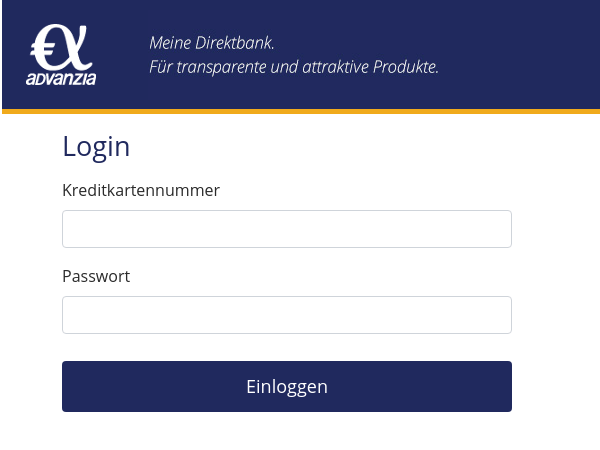

You can apply for an Advanzia Credit Card online by filling out the application form on their website. They will review your application, and if approved, they will send you the card along with your PIN and login details.

What is the Advanzia Mastercard Gold limit?

The credit limit for an Advanzia Credit Card depends on your creditworthiness and financial situation. They will determine your credit limit based on your income, expenses, and credit score.

How do I make payments for my Advanzia Bank Gold Mastercard?

You can make payments for your Advanzia Credit Card online through their online banking portal or mobile app. You can also set up a direct debit from your bank account to make automatic payments.

What are the fees associated with an Advanzia Mastercard?

Advanzia Credit Card has no annual fees, no foreign transaction fees, and free cash withdrawals worldwide. However, they charge an interest rate on the outstanding balance and a fee for cash advances and late payments. It’s essential to read the terms and conditions before applying for the card to understand all the fees and charges.